January 09, 2026

NRF Big Show: Customer Loyalty Is Largely Apathy According to SAP Emarsys Insights

The US National Retail Federation Big Show is kicking off in New York this weekend and SAP Emarsys has new insights for attendees. Data from its Customer Loyalty Index (CLI) and Buyer Loyalty Index (BLI) reports highlight the growing difference between stated loyalty and actual customer behaviour.

It turns out that those “loyal” retail customers who previously loved a brand are switching quickly whenever price, poor experiences, controversies, or sustainability concerns become an issue.

For business sales, they note the B2B market is experiencing similar apathy, with many only staying out of “Default Loyalty” — sticking with vendors simply because switching is too difficult, with vendor lock-in, migration issues and the pain of retraining.

The Slide Away From True Loyalty

Kicking off on Sunday, the show will be keynoted by none other than Ryan Reynolds, with masterclasses and sessions on AI in retail.

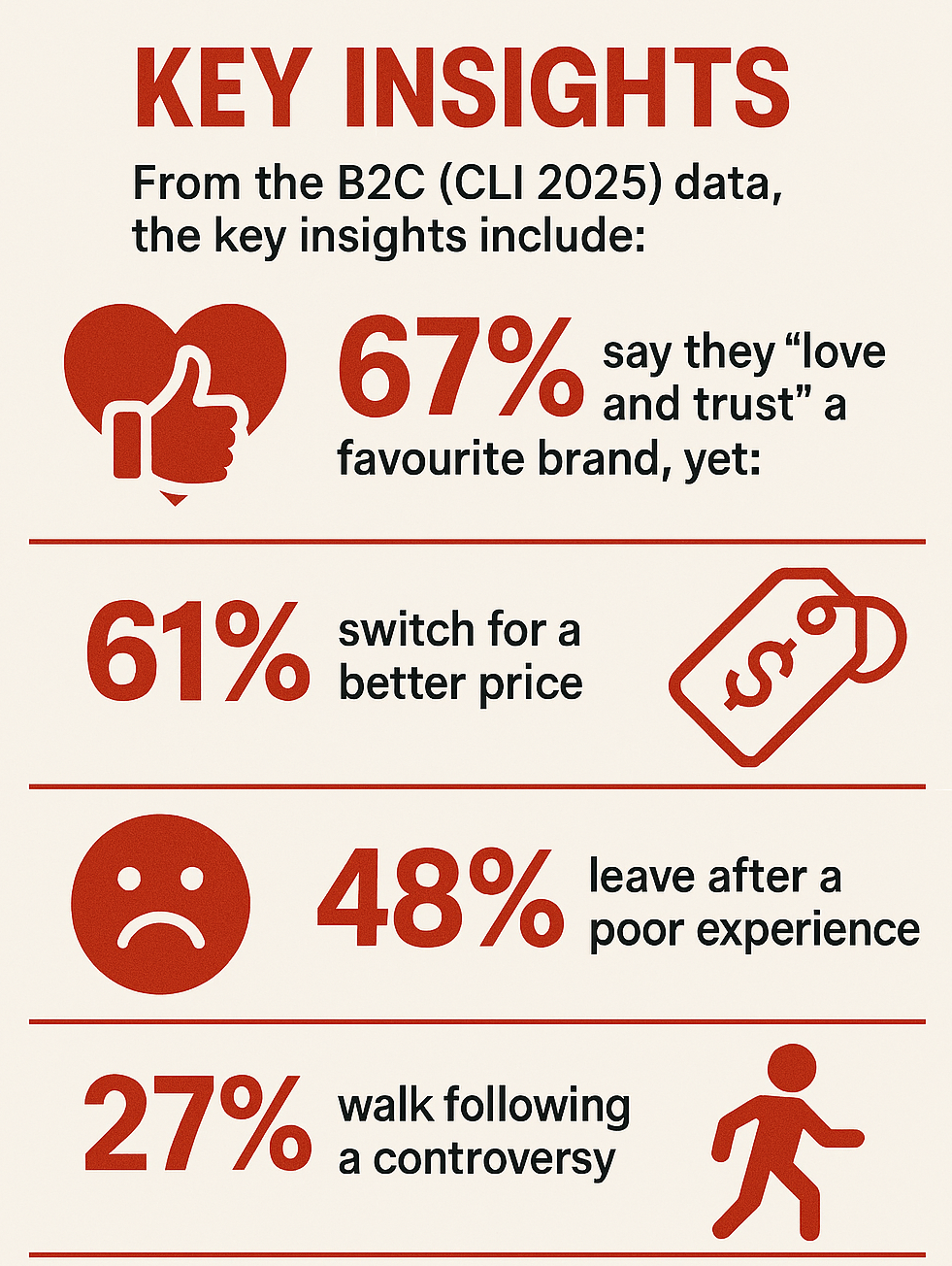

SAP Emarsys will present their findings, revealing that while 67% of consumers say they “love and trust” a favourite brand, both shoppers and businesses are increasingly drifting away.

Three in five (61%) of shoppers switch for a better price, while almost half (48%) abandon a brand for a poor experience. This comes after last year’s data showed 83% of consumers felt undervalued. Perhaps more of them will do something about it this year.

B2B’s Default Loyalty Problem

Meanwhile, B2B buyers stay with suppliers out of habit or because switching is too hard. The BLI finds that 72% of B2B buyers have Default Loyalty, based on the pain of switching rather than the value of a partnership.

“Quiet quitting has come to retail, and its B2B counterpart is Default Loyalty,” said Sara Richter, CMO, SAP Emarsys. “Both look like loyalty but are fragile. The reason? Internal complexity rather than a lack of intent. Every brand wants to engage better but many are not yet able to do so.”

Enter ‘dark data’: the signals brands already collect but can’t activate because they’re trapped in disconnected systems across technology, service, marketing and revenue. It’s not lost or ignored, but brands fail to use it in real time without an intelligence layer.

“That’s why AI matters,” Richter added. “AI connects those signals so brands can deliver personalised, connected experiences across every touchpoint, every time.”

The ‘Loyalty Gap’ in Numbers

These insights are most likely the result of tight budgets, higher consumers expectations and fragmented journeys.

Despite oceans of data, over half of brands say their data is too unstructured to use, and a similar amount cannot act in real time, with 27% likely to exit over sustainability concerns.

The result: faith-based loyalty instead of evidence-based engagement, because the signals that predict churn sit in silos.

“This is the essence of what has become known as the Engagement Era,” said Richter. “Understanding how customers engage beyond transactions and using one intelligence layer to interpret signals across technology, service, marketing and revenue in real time. Traditional marketing platforms weren’t built for that.”

Loyalties will always shift, but the brands claiming high loyalty probably need to check in with their customers to make sure it isn’t any more than a box-ticking exercise on both sides of the equation.