June 03, 2025

Pfizer develops CX metric for pharma field reps

Every industry needs to develop its own flavour of CX. Some industries are further ahead like retail, banking, telecoms. Other sectors are just starting out, such as construction, engineering, media, or pharma.

Within a heavily regulated industry like pharma, any customer experience model has to adapt to a multitude of separate market drivers depending on where customer experience is being applied.

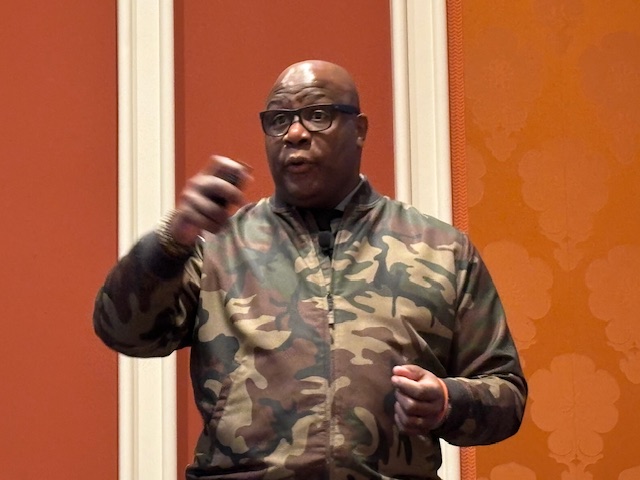

“In pharma customer experience is still very nascent,” Wayne Simmons, chief marketing office, global customer excellence lead, Pfizer, told Customer Experience Magazine.

“It is still being figured out… there is no ‘one answer’, because pharma is so complex,” he added.

For example, the medical needs around Oncology vary wildly from those in primary care. Each sub ‘disease state’ is in effect their own competitive market, with their own rules and market drivers.

No, ‘one size fits all’

Simmons has spent the last two years with Pfizer assembling its global CX strategy. Within the organisation there was a growing recognition that CX had to become a corporate level goal.

“It’s like a three-legged stool — you have the product, the brand, and you have the experience,” said Simmons.

“We have to compete and add value to all three dimensions. That was the impetus to move on this [CX],” he added.

Pfizer’s global CX framework will be cascaded down into its international markets depending on local priorities. Local patient health and experience experts will inherit responsibility for local CX delivery.

“The implementation is different depending on the market,” said Simmons. “There is a huge benefit to making things local rather than trying to impose the same [approach] on everyone,” he added.

NPS doesn’t mean a lot in pharma

Customer experience work at Pfizer has evolved in two phases. The initial phase started around two years ago. Then it rolled out transactional and relational surveys to develop an enterprise view of the brand, in relation to net promoter score (NPS).

But unfortunately NPS doesn’t mean a lot in pharma. “Doctors don’t go around asking about loyalty. So we have to really take customer experience and tailor it to the business,” said Simmons.

Consequently, phase two has focused on face-to-face interactions of the sales and medical reps, and the healthcare professionals (HCPs). Chapter two (as Simmons’ calls it) of Pfizer’s CX journey is built around gathering feedback and sentiment from the field reps, so Pfizer’s marketers can deliver better, more relevant content for doctors.

“We need to help healthcare professionals to stay educated on what’s going on, but we want to make sure it’s a relevant, personalised interaction,” explained Simmons.

Human-to-human interactions

“It is really about these human-to-human interactions between our field reps and HCPs, and how we make it better for both of them,” he added.

Given the specialised nature of pharma, Pfizer has found itself developing a specialised metric to judge its CX progress. The new metric is as much about employee experience as customer experience.

“Employee experience drives customer experience — that dynamic has been established. So, we’re trying to take that same concept and adapt it. If we can give a great ‘field’ experience, they’ll have a better experience with the HCPs,” said Simmons.

Tying CX outcomes to the business

The new metric enables Pfizer to tie the outcomes of its CX/EX programme to the business. Although Simmons isn’t able to mention specific figures, the new metric is proving its worth.

“We are using the formulas of customer experience and applying it in a commercial context. It is really working out well,” he added.

The metric is being continually developed in conjunction with sales and medical field reps through a series of regular surveys. Reps are quizzed on the level of support they need in terms of content and time. “It’s an internal survey to measure our ability to enable them to do their jobs,” commented Simmons.

Increasingly, the field reps have taken ownership of the process. That has been a “big leap”, added Simmons.

Medallia handles the survey data

Pfizer is already using Medallia to correlate its customer and employee feedback. As the pharma giant moves forward, it plans to automate the process further, shifting from six-monthly surveys to an “ongoing sampling process, so we’re getting ongoing feedback,” added Simmons.

The business is looking at ways artificial intelligence (AI) can make sense of the vast amount of feedback it gathers. The work will enable it to extract information from far more customer touchpoints than just surveys.

“We’re talking about real signals from contact centres, calls notes, any number of unstructured data sources. This [information] is flowing in every day. We have millions of interactions a year with field reps and HCPs,” commented Simmons.

How the organisation makes sense of that data for both the benefit of itself and its community of HCPs will make up much of the third phase of Pfizer’s CX model.