October 22, 2025

Poor Digital Experiences See 1-in-5 Health Insurance Policies Cancelled

The joy of easily signing up for a health, or other, insurance policy through a web form can soon be tempered by a poor customer experience on the other side of the welcome page.

New research from Graphite Digital shows that poor digital experience was the reason 21% cancelled or are considering policies in the past year.

Poor digital experiences could be costing private health insurers, with two in five (40%) consumers who have held insurance in the past 12 months cancelling their policies, letting them lapse, or considering a switch.

Ensuring Strong Insurance Experiences

The 20-page report, “Redefining digital experience in health insurance” from Graphite Digital, based on a survey of 2,000 UK adults conducted in August 2025 , shows that:

One in five (21%) have cancelled or are considering not renewing due to poor digital experiences, or poor customer service (19%), only a little below those making a change due to rising premiums (28%).

- Content and usability are the most common frustrations, with 45% feeling overwhelmed and 37% experiencing issues with interface quality and speed.

- Good digital onboarding processes have the greatest impact when it comes to building confidence and trust (41%).

- While most (69%) insured consumers have used their provider’s app or website in the past year, satisfaction is far from guaranteed.

- Insurers apps are falling flat for consumers, with two in five (39%) saying that their insurer’s app or website is not as good as others they use.

- Some 31% finding the experience frustrating.

These disappointing digital experiences are putting retention at risk, with poor customer service (37%), poor technical reliability (28%) and dissatisfaction with app or website experience (24%) driving disengagement and impacting decisions to stick or switch.

Talking A Better Health Insurance Experience

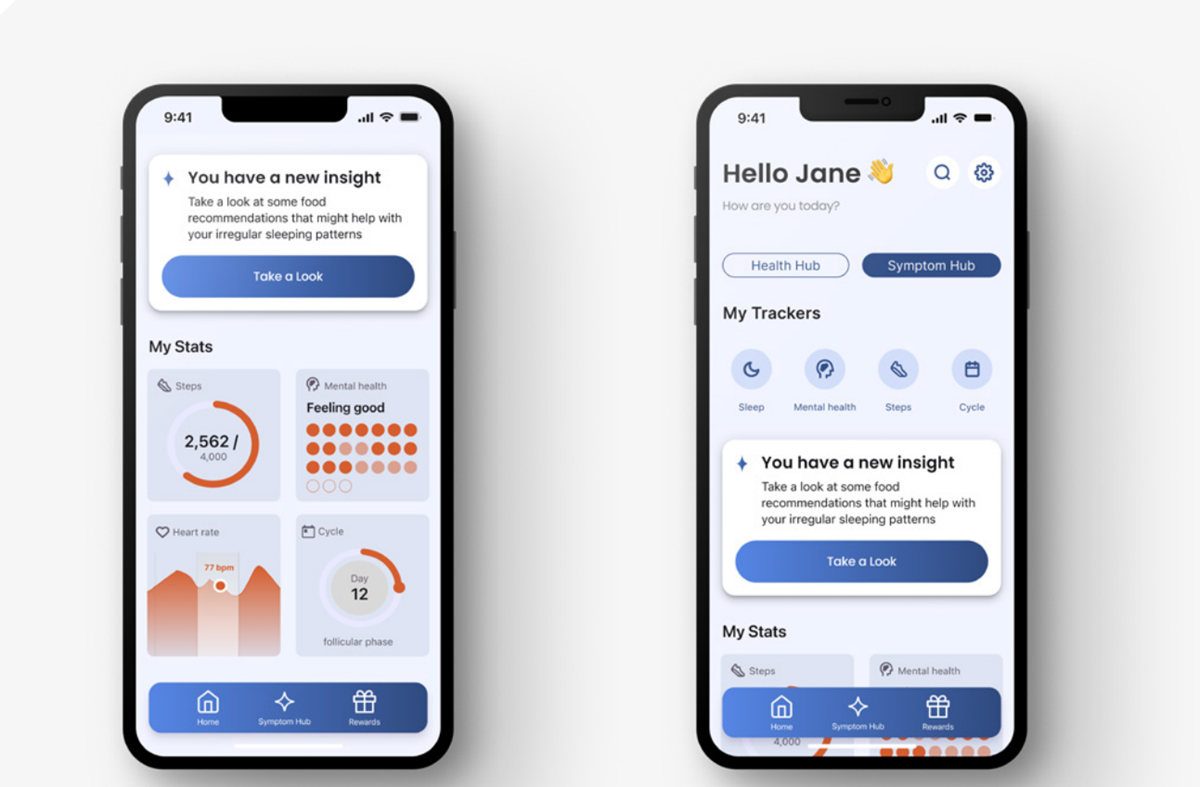

While poor experiences drive customers away, their first impressions of an app or website set the tone and build lasting trust.

A smooth, secure and purposeful onboarding process is the most influential factor in building confidence among consumers (41%), with high-quality experiences in terms of speed (33%), quality (29%), and personalisation (27%) also playing important roles.

Rob Verheul, CEO at Graphite Digital, said: “While cost remains critical, the future of health insurance will be won or lost on customer experience. Consumers’ experiences shape their perception of health insurers, with clunky processes, confusing platforms and a lack of value proving to be just as decisive as an unaffordable premium in driving customers away while exceptional experiences build lasting trust.

“Insurers’ digital platforms may be falling flat, but they can set things right by shifting their focus from cover to connection. Investing in pivotal trust moments like onboarding and claims, as well as creating additional value through personalisation and relevant, visible preventative content, could be the difference to winning or losing on the battleground of retention.”

Graphite Digital’s top tips for insurers who want to shape up their digital experiences:

- Put user needs ahead of organisational silos

- Create design journeys that feel consistent and intuitive across channels

- Invest in onboarding and claims as relationship-defining moments

- Make preventative, everyday value visible through digital touchpoints

Across the entire health sector, the push is on for automation, scale and productivity. But when it comes down to people with health issues, technology cannot elevate every part of the conversation. We look forward to seeing insurers balance the use of tech and AI with the human touch across the rest of the decade.